The worst is still ahead…

Nouriel Roubini, (aka Dr. Doom), has been amazingly prescient with his accurate predictions of how the credit crisis would unfold.

He spoke at an NYU-Stern School of Business Panel last week and predicted the financial-market meltdown would trigger a prolonged recession lasting 18-24 months and quite possibly more. He said hopes for a sharp “v-shaped” recovery have been dashed in recent weeks and that the United States is in for a long recession and a slow recovery.

Roubini argues that the worst is still to come, with more ominous headlines about economic measure like unemployment and GDP on the horizon. Among the headline-grabbing statistics Roubini predicts unemployment will rise to 9% and that home prices will fall an additional 15% from already depressed levels.

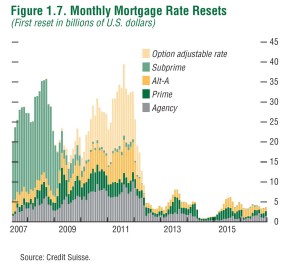

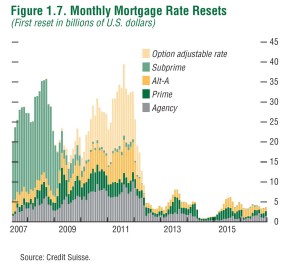

Illuminating the headwinds facing a housing recovery, Anthony Freed blogs about the coming Alt-A and Option ARM mortgage resets. One picture from Anthony’s blog tells a thousand frightening words about the pain that is still to come in the housing market:

Click here to view in larger window

Roubini cites several variables in addition to the eight-hundred pound housing gorilla that will prolong the downturn and temper the economic rebound:

Erosion of corporate earnings – Roubini feels that current estimates for corporate earnings are far too optimistic and expectations haven’t been adjusted to the new reality that is just now presenting itself. He contends that corporate earnings will surprise to the downside, leading to more pain in the financial markets. As the credit crisis bleeds into the broader economy, the range of companies affected by the economic slow-down will not be limited to financials, but will spread to all sectors of the economy.

Further blow-ups in credit default swaps – Roubini predicts that the economic stress will lead to corporate debt defaults outside of the financial sector. These defaults will trigger additional losses in the CDS market. Roubini has upped his estimate of total credit losses from $1-2 trillion to $3trillion. Estimates of the total value of credit default swaps in the market vary, but most are in the neighborhood of $55 trillion. To put that number in perspective, SEC Chairman Christopher Cox wrote about AIG’s CDS exposure:

As large as A.I.G.’s swaps exposure was, it represented only 0.8 percent of the $55 trillion in credit-default swaps outstanding — this total market is more than the gross domestic product of all nations on earth combined.

With that level of exposure to credit default swaps in the marketplace, even a small number of defaults can trigger major losses for the sellers of swap protection.

— more on credit default swaps in a future post —

Continued deleveraging – Hedgefunds are experiencing a double-whammy of massive redemptions requests from investors and margin calls from banks and prime-brokers whose appetite for risk is suddenly much smaller. Many of these hedgefunds are levered up by two, five, ten times, or more; that’s before they invest in derivatives that effectively leverage their balance sheets even further. Funds are being forced to sell and sell fast. Roubini believes the deleveraging will continue for some time and will add fuel to the current market panic. It is a vicious cycle that is difficult to break.

Spillover to emerging markets – We’ve seen it with Iceland which nationalized the nation’s three largest banks and is now in talks with Norway and the IMF after talks with Russia ended without a deal rescue its failed banking system. It doesn’t look like it will be a very merry Christmas for China either; the soft economy in the United States has led to the closure of many factories that make toys for Hasbro and Mattel. The United States has been the world’s consumer of last resort. As the economy in the U.S. enters a recession it will hit the emerging markets that produce the T.V.’s, toys, and iPods that American consumers have wantonly consumed on a debt-fueled diet for the past decade. Natural resource exporters will also feel the pain as demand for oil, gas, steel, and other commodities slows alongside the global economic growth.

Roubini is painting a very dark picture; perhaps Joe Biden had just seen Roubini on CNBC when he advised people to “gird their loins” for the coming challenges we will face.

Pretty dark stuff… how about some puppies to cheer you up?

Want more posts like this? Leave a comment below…

Coming up…

Candidates on Immigration – check back this evening

Credit Default Swap Primer

Share this post

Subscribe to SpeciousRiches

Subscribe via RSS

Subscribe via RSS

Related Reading:

The New Paradigm for Financial Markets: The Credit Crisis of 2008 and What It Means

For those intrigued by my credit default swap post, there is a good article in yesterday’s New York Times. The article asks, “where are the funds being lent to AIG by the Fed going within the company”

For those intrigued by my credit default swap post, there is a good article in yesterday’s New York Times. The article asks, “where are the funds being lent to AIG by the Fed going within the company”